Ecommerce product data often reveals market gaps long before products go viral. Early signals appear in fragmented assortments, inconsistent attributes, and unmet demand across marketplaces. These signals surface quietly in data, well before trends become visible to the wider market.

What Is Ecommerce Product Data?

Ecommerce product data is often reduced to product listings or catalogs. In practice, it represents a much broader and more dynamic layer of market information.

Ecommerce Product Data Beyond Product Listings

At scale, ecommerce product data includes:

- Product titles, descriptions, and attributes

- Category and subcategory placement

- Variants, bundles, and configurations

- Seller and brand associations

- Availability, stock status, and lifecycle changes

When collected consistently, this data forms a time-series view of the market, reflecting how products, sellers, and categories evolve in response to demand.

Why Market Gaps Rarely Appear Overnight

Market gaps are not sudden events. They develop gradually as consumer needs shift faster than supply structures can adapt, creating market inefficiencies across fragmented assortments and inconsistent product offerings.

From Weak Signals to Visible Demand

Early-stage market gaps often share common characteristics:

- Demand expressed across many small, inconsistent listings

- Lack of standardized product attributes

- Wide variation in quality, pricing, or positioning

At this stage, demand exists, but no dominant product or brand has emerged to capture it.

Why Viral Trends Are a Lagging Indicator

By the time a product becomes “viral,” several things have already happened:

- Supply has standardized around winning configurations

- Visibility has increased through promotion and content

- Competition has intensified

Viral signals reflect confirmation, not discovery. Ecommerce product data captures opportunity before this convergence occurs.

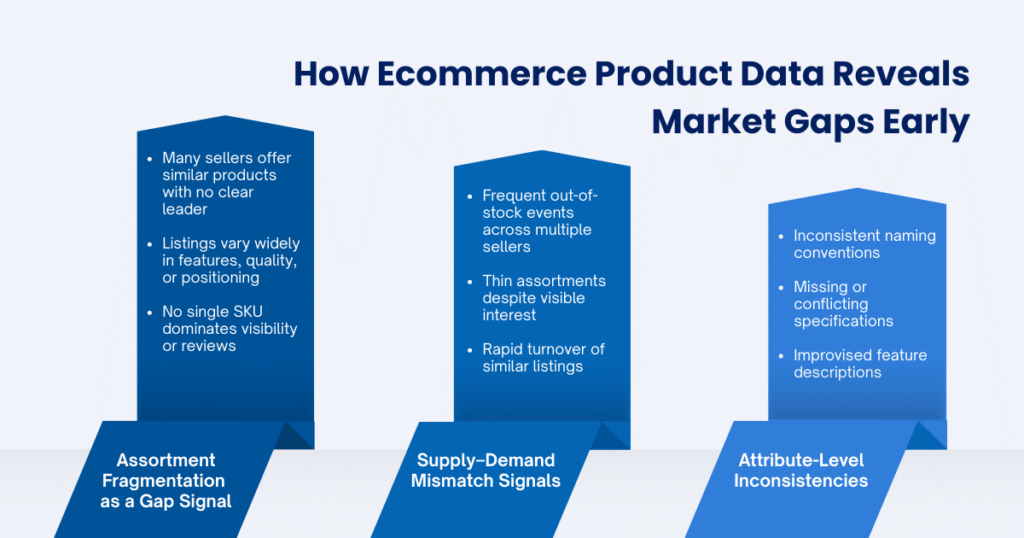

How Ecommerce Product Data Reveals Market Gaps Early

Ecommerce product data provides a direct lens into what the market is trying to become, before it becomes obvious.

Assortment Fragmentation as a Gap Signal

One of the strongest early indicators of a market gap is fragmented assortment. This appears when:

- Many sellers offer similar products with no clear leader

- Listings vary widely in features, quality, or positioning

- No single SKU dominates visibility or reviews

Fragmentation suggests unresolved demand. The market is searching for a solution that has not yet been clearly defined.

Supply–Demand Mismatch Signals

Availability patterns add further clarity. Market gaps often coincide with:

- Frequent out-of-stock events across multiple sellers

- Thin assortments despite visible interest

- Rapid turnover of similar listings

Together, these patterns suggest demand pressure without sufficient supply maturity.

Attribute-Level Inconsistencies

Another signal emerges at the attribute level. Product data often reveals:

- Inconsistent naming conventions

- Missing or conflicting specifications

- Improvised feature descriptions

These inconsistencies indicate that sellers are experimenting, but the category lacks a shared understanding of what customers truly value.

Market Gaps vs Trending Products

Early market gaps and late-stage trends may appear similar on the surface, but they represent very different phases of market evolution.

| Market Gap Signals | Viral Product Signals |

|---|---|

| Fragmented assortments | Standardized hero SKUs |

| Low visibility | High exposure |

| Inconsistent attributes | Consistent positioning |

| Early, unstable demand | Peak or saturated demand |

Market gaps represent opportunity formation, while viral products represent opportunity realization. Ecommerce product data is most valuable in the former stage.

Why Identifying Market Gaps Early Creates Strategic Advantage

Identifying market gaps early is not about being first to follow a trend, but about gaining strategic options before markets converge. Early signals allow organizations to act while uncertainty is still high and competition remains fragmented.

Preserving Strategic Flexibility

When market gaps are detected at an early stage, businesses retain flexibility in how they respond. Instead of competing on price or visibility in saturated categories, teams can shape product definitions, positioning, and assortment strategy before standards are set.

Reducing Cost of Entry and Experimentation

Early-stage gaps typically involve lower competition and less bidding pressure. This reduces the cost of experimentation, allowing organizations to test product concepts, attributes, and pricing logic with lower risk compared to entering an already viral market.

Capturing Demand Before Standardization

Before a market matures, customer demand is often scattered across imperfect solutions. Detecting gaps early enables teams to consolidate this demand into clearer offerings, rather than competing against established hero products once expectations are fixed.

Building Insight Before Visibility

Market gaps become widely visible only after products go viral. Ecommerce product data exposes these opportunities earlier, providing insight advantage before public signals such as rankings, reviews, or social traction dominate decision-making.

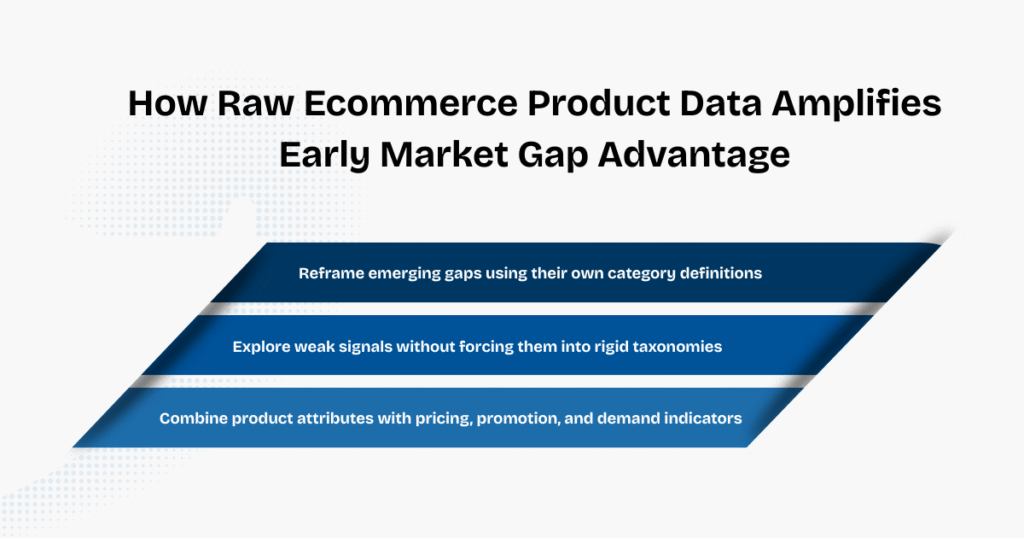

How Raw Ecommerce Product Data Amplifies Early Market Gap Advantage

Identifying market gaps early creates strategic advantage only if organizations can act on those signals with speed and flexibility. The quality and structure of underlying data directly determine how effectively early insights can be explored, validated, and translated into decisions.

Pre-built insights and fixed dashboards are often designed around predefined metrics and assumptions. While they offer convenience, they tend to constrain how market gaps are interpreted, especially when categories are still forming and signals remain ambiguous.

Raw ecommerce product data, by contrast, preserves analytical freedom at precisely the stage where it matters most. It allows teams to:

- Reframe emerging gaps using their own category definitions

- Explore weak signals without forcing them into rigid taxonomies

- Combine product attributes with pricing, promotion, and demand indicators

In early-stage markets, insight advantage depends less on having answers and more on being able to ask better questions. Raw data supports this by keeping interpretation open, rather than locking analysis into pre-built views.

At this stage, the difference often lies not in interpretation, but in data access. When teams rely on raw ecommerce product data, the ability to explore early signals depends heavily on how that data is sourced and structured. Rather than offering fixed conclusions, raw e-commerce data providers like Easy Data focus on delivering large-scale, well-structured datasets, generated through Lazada/TikTok Shop/Shopee data scraping, that remain flexible enough to support a wide range of analytical approaches.

By working with raw datasets rather than pre-processed insights, organizations retain control over how early market gaps are examined, tested, and operationalized, maximizing the strategic benefits of early detection before markets mature.

Ecommerce Product Data in a Broader Market Intelligence Context

Product data delivers its highest value when viewed across platforms and over time. Combined with data from multiple marketplaces, ecommerce product data helps reveal:

- Cross-platform category convergence

- Differences in assortment maturity between channels

- Structural shifts at the industry level

This broader perspective transforms product data from isolated observations into a coherent view of market evolution.

Final Thoughts

Market gaps rarely announce themselves. They emerge quietly through fragmented assortments, inconsistent attributes, and unstable supply patterns. Ecommerce product data is where these signals appear first. Long before trends become visible or products go viral, product data reveals how markets are forming and where opportunity is building beneath the surface.

For organizations focused on long-term advantage, the ability to read these early signals is not optional. Market gaps are data signals before they are headlines.

Leave a Reply