Across ecommerce research projects, agencies often begin with a deceptively simple question: what exactly does this market contain?

Answering that question at scale typically starts with an ecommerce products list – a structured view of products that defines market boundaries before any deeper analysis begins.

Rather than being a raw export, an ecommerce products list serves as a foundational research asset that supports category definition, competitive mapping, and repeatable reporting across platforms and regions.

What an Ecommerce Products List Represents in Market Analysis

In professional research contexts, an ecommerce products list represents how a marketplace organizes supply at a specific point in time. From a methodological standpoint, it functions as:

- A market scope definition

- A category taxonomy proxy

- A baseline for competitive presence analysis

Agencies rely on product lists not to explain performance, but to ensure that subsequent analysis is grounded in a clearly defined and consistently applied market frame.

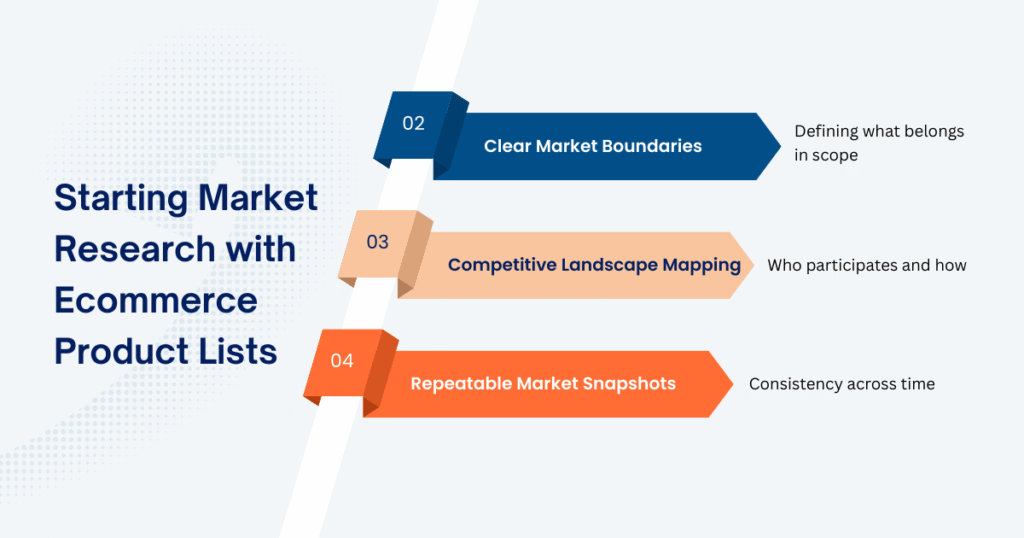

Why Agencies Use Ecommerce Product Lists as a Research Starting Point

Before modeling demand or forecasting trends, agencies need a reliable way to establish what is included in the market and what is not.

Establishing Category Boundaries

Ecommerce platforms structure categories differently by country, seller behavior, and internal taxonomy changes related to product taxonomy. A consolidated ecommerce products list allows agencies to:

- Normalize category definitions

- Align multi-market research scopes

- Reduce ambiguity between research teams

Without this foundation, category-based analysis often becomes inconsistent and difficult to replicate.

Mapping the Competitive Landscape

An ecommerce products list enables agencies to quickly assess:

- Brand and seller participation

- Market fragmentation versus concentration

- Coverage gaps within categories

These structural insights are essential inputs for market and category reports, especially in highly competitive ecommerce environments.

Creating Repeatable Market Snapshots

Because product lists can be refreshed periodically, agencies use them to build:

- Comparable category snapshots over time

- Stable reporting baselines

- Consistent inputs for longitudinal studies

This repeatability is critical for agencies producing recurring market updates or syndicated reports.

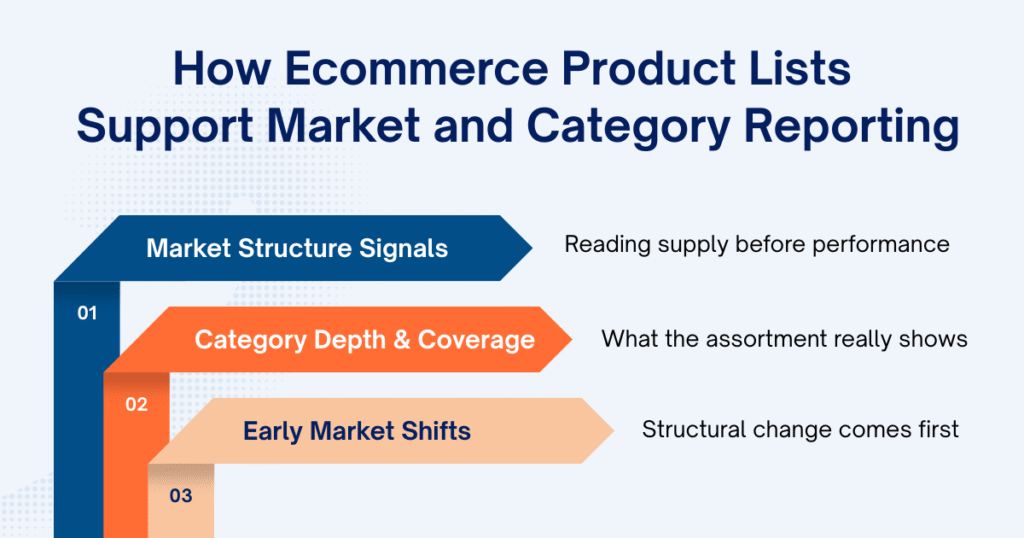

How Ecommerce Product Lists Support Market and Category Reporting

When integrated into research workflows, an ecommerce products list becomes more than a reference, it becomes an analytical asset.

Market Structure and Size Indicators

By aggregating products at category and subcategory levels, agencies can infer:

- Relative market breadth

- Long-tail versus concentrated supply patterns

- Structural differences between regions or platforms

While not a substitute for sales data, these indicators provide early context for market maturity and competitive intensity.

Category Depth and Attribute Coverage

Analyzing product attributes within an ecommerce products list helps agencies identify:

- Feature saturation

- Product differentiation patterns

- Assortment gaps within categories

These insights often inform strategic recommendations long before pricing or demand data is introduced.

Detecting Early Market Shifts

Changes in ecommerce products lists over time (such as rapid SKU expansion or new subcategory emergence) often surface structural trend signals before performance metrics reflect them.

For agencies, these signals are particularly valuable in fast-moving ecommerce categories.

Ecommerce Product Lists vs Full Product Datasets

Understanding the role of ecommerce products lists requires distinguishing them from deeper datasets.

| Dimension | Ecommerce Products List | Full Product Dataset |

| Primary role | Market framing | Performance analysis |

| Data depth | Structural | Behavioral |

| Update cadence | Periodic | Continuous |

| Best use cases | Scoping, reporting | Pricing, forecasting |

Agencies typically use product lists as a first-layer dataset, expanding into richer data only when research questions demand a broader e-commerce dataset that supports pricing signals, historical depth, and model-ready structures.

Limitations of Using Product Lists in Isolation

While essential, ecommerce products lists are not designed to answer every question. Common limitations include:

- No direct measurement of sales performance

- Limited pricing dynamics visibility

- Insufficient granularity for forecasting models

These limitations reflect the purpose of product lists: defining what exists, not how it performs.

How Agencies Source Reliable Ecommerce Product Lists

The analytical value of an ecommerce products list depends heavily on how it is collected and structured. High-quality product lists typically:

- Preserve consistent category logic across updates

- Resolve duplicates across sellers and category paths

- Maintain stable identifiers over time

A well-designed ecommerce products list includes reliable marketplace identifiers (often sourced through ecommerce data scraping processes) that preserve context across platforms, regions, and time.

In practice, agencies either build and maintain these pipelines internally or work with specialized data providers who focus on delivering structured, research-ready product lists. In such cases, providers like Easy Data operate behind the scenes, supplying clean inputs while agencies retain full ownership of analysis and interpretation.

Product Lists as Part of a Broader Research Stack

In most agency workflows, ecommerce products lists act as an entry layer within a larger data ecosystem that may later include:

- Product-level datasets

- Pricing and promotion data

- Sales or demand indicators

Seen this way, the product list establishes analytical structure before deeper performance data is layered in.

Final Thoughts

For agencies producing market and category reports, an ecommerce products list is a foundational research asset rather than a supplementary one. When properly designed and maintained, product lists help define market boundaries, map competition, and support repeatable analysis across platforms and regions, long before performance data enters the picture. Used strategically, they enable agencies to move faster, align research scope, and build insights on a stable analytical foundation.

Leave a Reply