In Shopee’s diaper category, pricing is not simply a competitive factor, it is the primary determinant of brand success. The market is extremely competitive, products are highly substitutable, and profit margins are thin; therefore, even minor price adjustments directly influence market share and growth.

Buyers on Shopee are among the most price-sensitive across all e-commerce platforms. They make rapid comparisons based on listed prices, discount percentages, and the final price after vouchers. A difference of only 1-2 USD or a 5-10% deviation in discounts is often enough to shift buyers to another brand.

Moreover, diapers are a highly repeat-purchase FMCG category. A well-designed pricing model not only drives immediate sales but also secures a recurring position in customers’ monthly shopping carts. Shopee Vietnam diaper is forming two contrasting market pictures: large brands can maintain stable pricing based on trust and reputation, while smaller brands must rely heavily on low-price or deep-discount tactics to stay competitive.

Pricing, therefore, becomes the pivotal factor that determines which brands lead and which exit the market. The disciplined pricing approaches of Shopee Vietnam diaper brands like Huggies, Bobby, and Gooby clearly illustrate this dynamic.

Market Overview: How Pricing Shapes the Entire Shopee Vietnam Diaper Category

Shopee Vietnam diaper market in October 2025 reveals three defining characteristics: strategic discounting, clear price segmentation, and consumer behavior heavily driven by final post-discount prices. The market’s structure depends far less on branding strength and far more on how each price tier deploys its pricing strategy.

Pricing Trends

- Stable, disciplined discounting among top brands: Data shows that market leaders maintain highly consistent discount levels: Huggies: 19.68% – Gooby: 19.17% – Bobby: 18.49%. This “price discipline” model allows strong profitability while sustaining high sales.

- Deep discounts no longer guarantee success: Salama offered a 44% discount yet recorded low volume. This demonstrates a “false economy”: deeper discounts yield diminishing returns when not supported by strong brand value.

- Extreme discount strategies succeed only in the budget segment: Bejoyle: 34.67% discount + 5.52 USD base price → 264,000 monthly sales (market-leading). This is the “discount moat” model: using ultra-low pricing to lock in the budget segment.

Price Segmentation

| Segment | Characteristics | Avg. Price (USD) | Strategic Meaning |

| Budget | Very price-sensitive buyers | 5 – 8 | High volume, low margin; suited for penetration pricing |

| Mid-range | Largest, most competitive tier; trust + quality drive purchase | 12 – 17 | Balanced margins, large market share |

| Premium | High-income buyers prioritizing quality | 19 – 25 | Low price sensitivity; brand trust > discount |

Consumer Behavior Insights

- Buyers focus on the final post-discount price: Buyers compare multiple stores within seconds to find the best final price. A 1–2 USD difference can trigger a brand switch. This explains:

- Discounts >20% in premium deliver limited returns

- Discounts have outsized impact in the budget segment.

- Mid-range & premium buyers prioritize brand trust over price

Examples:

- Gooby sells at 19.02 USD (40% higher than Huggies) yet ranks #2 in sales.

- Huggies leads the market with only ~19% discount.

Strong brand equity reduces price sensitivity, meaning aggressive discounting becomes unnecessary.

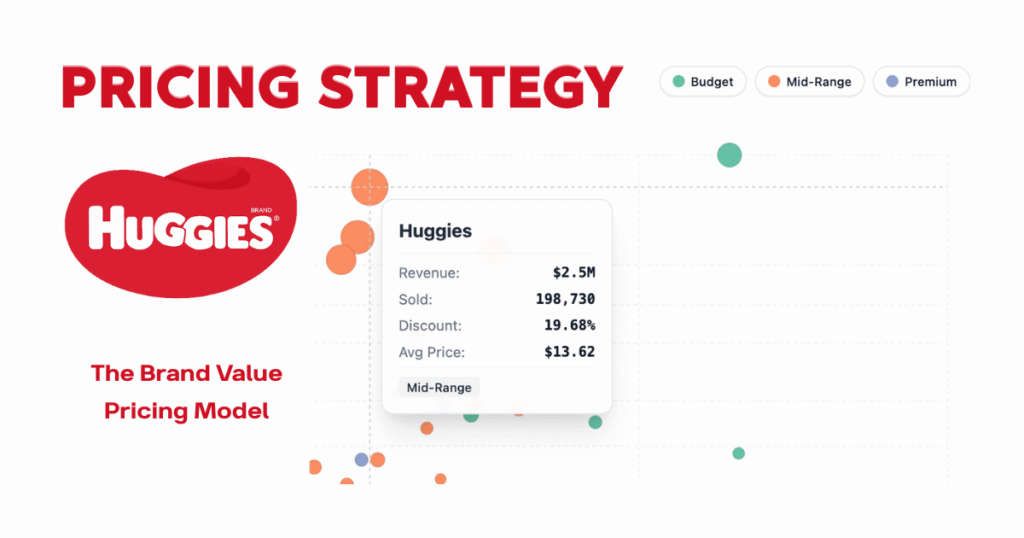

Giant #1: Huggies – The Brand Value Pricing Model

1. Pricing Strategy

Huggie’s “20% Rule” is not merely a discount cap, it is a value-protection strategy. Excessive discounting could:

- Lower perceived product value

- Create unsustainable expectations (customers waiting for deeper promotions)

- Trap the brand in a cycle of “discount → devaluation → deeper discounting”

Huggies strategically prices in the 13-19 USD range, keeping distance from mid-low competitors while staying below fully premium players like Gooby.

This is a classic Price Anchoring Strategy, simplifying customer decisions.

2. Why the Strategy Works

- Low price elasticity: customers are less sensitive to price changes.

- 93% of brand value comes from trust and perceived quality (FMCG loyalty model).

- Top-of-mind awareness provides a natural revenue moat.

- Stable discounting builds predictable repeat-purchase behavior.

Huggies wins by “pricing to preserve value,” not “pricing to chase sales”.

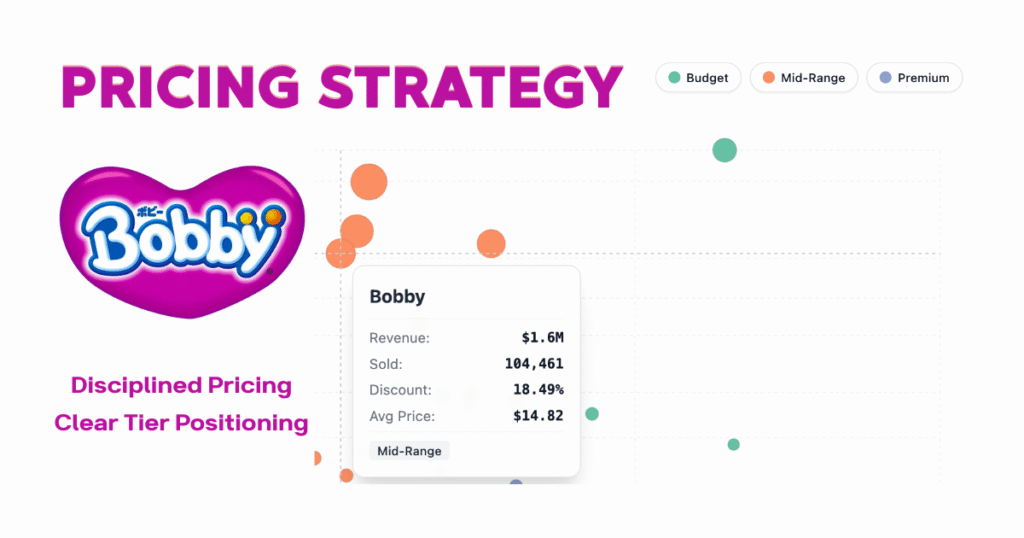

Giant #2: Bobby – Disciplined Pricing + Clear Tier Positioning

1. Moderate, Aligned Discounting

Bobby acknowledges its strategic position: not premium enough to compete with Gooby, but stronger than budget brands. Thus, it adopts a “shadow Huggies – avoid Bejoyle” strategy:

- Discount: 18.49%

- Price: 14.82 USD (upper mid-range)

This maintains competitiveness without sacrificing margins.

2. Clear Brand Positioning

Bobby positions itself as “near-premium quality at mid-range pricing.” This is effective because:

- It avoids the price war of the budget segment

- It doesn’t need heavy investment to compete in premium

- It appeals to the large, stable mid-upper buyer group

Stable pricing builds familiarity and trust among repeat buyers.

3. Results

- Medium price elasticity: buyers care about price but still value branding

- 100,000+ monthly sales without deep discount

- Customers choose Bobby for “value for money”

- Stable customer base with low seasonal fluctuation

Bobby succeeds by being the “safe, reasonable, trustworthy” choice.

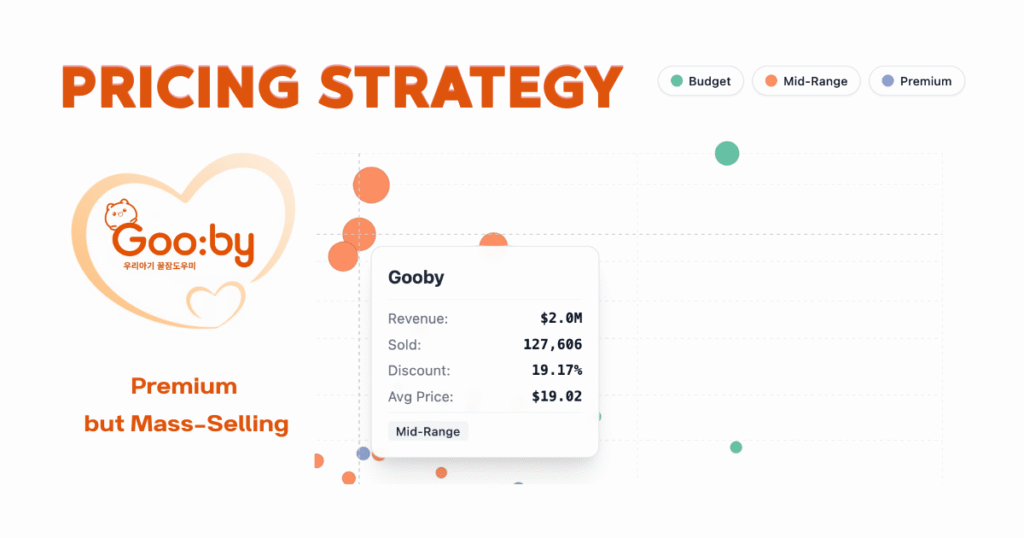

Giant #3: Gooby – The “Premium but Mass-Selling” Strategy

1. Market Differentiation

Gooby is a rare case: a premium-priced brand achieving high volume

- Price: 19.02 USD (40% higher than Huggies)

- 127,606 monthly sales (#2)

- 19.17% discount (similar to mid-range)

Customers view Gooby as “premium yet accessible.”

2. Why High Price Still Succeeds

- Affordable Luxury positioning: similar to Dyson or Laneige

- Focus on experience (“soft,” “breathable,” “gentle”) rather than features

- Premium buyers care more about experience than discount depth

- Price contrast effect: beside Bimana (24.12 USD), Gooby feels “premium but reasonable”

3. Key Lessons

- High pricing can reinforce brand differentiation

- Customers willingly pay more for meaningful product experiences

- Consistent ~19% discounting maintains premium image

- Premium brands win via margin + moderate volume, not extreme volume

Gooby demonstrates that premium pricing can break market norms when paired with differentiation.

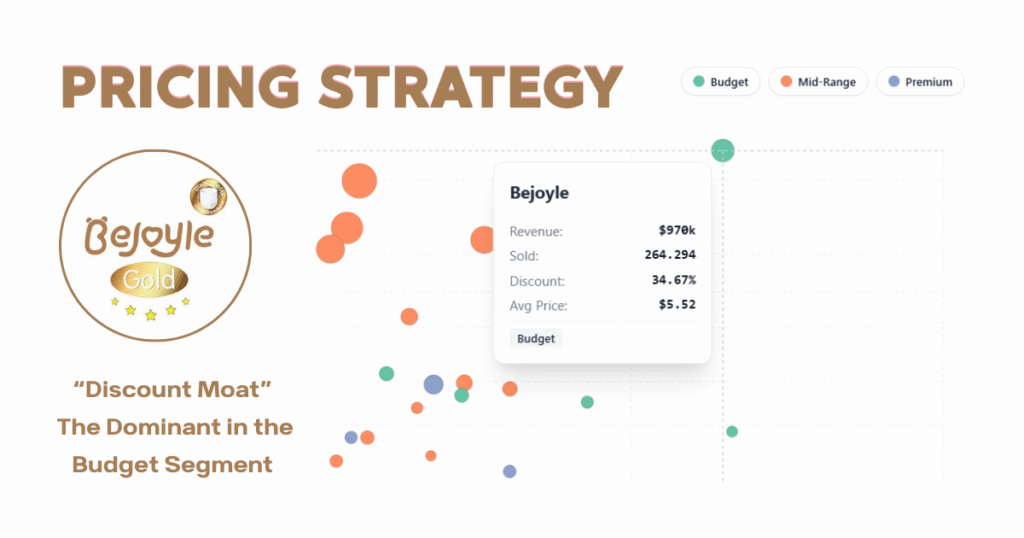

The Outlier: Bejoyle – The Dominant “Discount Moat” in the Budget Segment

Bejoyle succeeds by building an impenetrable price wall in the budget segment, where consumers are the most price-elastic.

1. Strategy

- Lowest base price: 5.52 USD

- Very high consistent discount: 34.67%

- Not seasonal; discount becomes part of the brand identity

Its promise to buyers: “Want cheap diapers? Bejoyle is the safest bet.”

Price becomes the brand’s value proposition.

2. Results

- 264,294 monthly sales (highest in the market)

- ~970,000 USD in revenue

- Low margin but massive volume

- Creates a price barrier that mid-range brands cannot cross without destroying their margins

Bejoyle sells “the lowest price that is still acceptable,” not premium features.

3. Lessons

- Budget buyers are extremely price-elastic (0.5–1 USD difference = brand switch)

- Limited brand equity prevents upward pricing

- Strategy is powerful but fragile—raising prices erodes its only advantage

- Cannot scale into mid-range due to lack of trust, product reputation, and quality perception.

Comparing The Top 3 Pricing Models: Why They Dominate

Despite contrasting strategies, the Shopee Vietnam diaper market leaders create a mutually reinforcing “strategic triangle” covering all customer needs – leaving no space for a fourth major competitor.

| Factor | Huggies | Bobby/Gooby Mid | Gooby Premium |

| Discount | 18-20% | 18-20% | ~20% |

| Avg. Price | 13-19$ | 12-17$ | 19$+ |

| Price Increase Ability | Medium | Low → Medium | High |

| Price Sensitivity | Low | Medium | Low |

| Target Consumers | Premium mothers | Mid-range mothers | High-income / premium buyers |

- Clear value-tiered positioning structure: The three leading brands have established a value-tier system that covers the full spectrum of customer needs without overlapping or competing directly with one another.

- Uniform discount levels but differentiated strategic purposes:Although all three maintain discounts in the 18-20% range, the role of these discounts differs by brand. Each applies this level for distinct strategic functions related to brand positioning, managing customer expectations, and protecting profit margins.

- Leveraging price elasticity to strengthen long-term advantage: Huggies and Gooby exemplify how strong brands can maintain low price sensitivity among their customers, creating the foundation for stable profit margins and greater pricing power in the future.

- Customer segments are tightly managed to avoid internal conflicts: Each brand owns a clearly defined customer segment, minimizing cannibalization, supporting parallel growth, and reinforcing a stable three-pillar market structure.

Strategic Pricing Lessons for Diaper Brands on Shopee

- Strong brands do not need deep discounts to sell well.

- Pricing must match each segment’s characteristics:

- Budget → low price + high discount

- Premium → differentiation + trust

- Excessive discounting produces diminishing returns (False Economy).

- Stable discounts increase repeat purchases in a high-frequency category.

- Pricing strategy should be segment-driven, not competitor-driven.

Conclusion

Market data shows that the top three Shopee Vietnam diaper brands do not dominate through low prices or aggressive short-term discounting. Their success is built on pricing discipline, strong brand foundations, and deep consumer understanding.

Huggies, Bobby, and Gooby each apply different pricing strategies but share one principle: optimize value according to customer needs and willingness to pay. Their clear, consistent market positioning forms a stable three-tier structure that creates strong barriers to entry.

The key lesson: “Price is not the end goal, it is a strategic tool for positioning, expectation management, and long-term competitive advantage”.

Leave a Reply