Shopee Search Trends serve as a critical raw input that enhances the competitive value of data products for data-driven enterprises. This article takes you deeper into how data insights can uncover Shopee Search Trends 2025 and transform them into real business advantage.

The Role Of Shopee Search Trends For Data-Driven Businesses

In 2025, the role of Shopee search trends for data-driven businesses has gone far beyond the scope of traditional market analysis. As Shopee continues to hold its position as one of the fastest-growing e-commerce platforms in Asia, search data from this platform has become a ‘key market signal’ – a strategic advantage for any data-driven business seeking to capture high-growth segments and gain a competitive edge. Specifically for data-driven businesses, Shopee search trends data plays the following roles:

- A high-frequency primary signal source

- Real-time behavioral data reflecting actual demand

- A training platform for AI/ML models

- The base layer for internal market intelligence systems

Especially for data businesses operating in AI Forecasting, Market Intelligence, Product Analytics, Pricing Intelligence, Demand Prediction, and Search Intelligence, all of which rely directly on raw data to build core data capabilities.

Shopee Search Trends 2025: Are You Up To Speed?

Since the Covid-19 pandemic, the online shopping trend has exploded, creating momentum for countless e-commerce platforms. Shopee is also one of the platforms attracting attention in many markets (most notably the Asian market).

If data-driven businesses aim to build a high-quality, competitive data product ecosystem in the market but overlook Shopee search trends, they are missing out on a significant opportunity. Below are notable Shopee search trends for 2025 that data-driven businesses should keep an eye on:

1. Wellness & Health (Supplements, Functional Beauty, Preventive Health)

Demand for personal health care and functional cosmetics is surging across Asia and Shopee’s emerging markets; users are searching for supplements and skincare products with specific ingredients (collagen, probiotics, vitamins). Regional Health & Beauty/e-commerce industry reports indicate this segment will be the growth driver for e-commerce in 2024–2025. Sea (Shopee) also noted improved monetization, with increased seller ad spend and search engagement.

2. Home Efficiency & Micro-Appliances (Compact/Smart Home Devices)

Regional e-commerce reports and Sea Q1/2025 show increases in GMV and gross orders, proving that household appliances and electronics are among the fastest-growing segments. This is due to urbanization and work-from-home trends driving increased demand for space-saving and convenient household products. Major sales events (9.9, 11.11, 12.12) create significant spikes.

3. Smart Personal Devices & Tech Gadgets (Smartwatches, TWS, Health Trackers)

The “connected life” trend is expanding the smart personal device segment; consumers search based on intent (fitness, health features vs. price). Sea notes and earnings decks emphasize user engagement features (live commerce, discovery) and search technology — aligning with increased searches for tech devices. Reuters/Bloomberg coverage of Shopee’s GMV growth supports the rising demand context.

4. Beauty / K-Beauty Revival & Ingredient-Led Searches

K-beauty and ingredient-focused skincare (niacinamide, retinol, centella) are experiencing a strong resurgence, with users increasingly searching by specific active ingredients rather than product names. This shift reflects a more educated consumer base that prioritizes science-backed formulations and targeted skincare solutions.

5. Sustainable / Circular Fashion & Micro-Trends

Demand for sustainable fashion is increasing among young consumers (E-commerce SEA & Gen-Z Market Report); driven by growing environmental awareness and ethical purchasing habits. At the same time, micro-trends emerge and disappear rapidly, creating a dynamic landscape where trend cycles are shorter than ever.

6. Pet Care & Premium Pet Products

Pet ownership is increasing in many Asian cities, leading to rising demand for premium food, health supplements, and stylish accessories. Consumers are willing to spend more on high-quality and specialized products as pets become increasingly viewed as family members.

7. Grocery & FMCG Online Acceleration

Online grocery shopping has grown significantly since the Covid pandemic, reshaping consumer habits toward convenience and recurring purchases. Shopee has actively expanded its FMCG and grocery categories across various markets, making daily essentials more accessible online.

8. Cross-Border & Premium Imports (Korea/China/Japan Brands)

Users frequently search for brand origins—whether K-beauty, J-beauty, or popular Chinese gadgets—indicating a strong interest in trusted international sources. Search queries increasingly include brand-country intent, suggesting consumers associate origin with quality and authenticity.

9. Second-hand / Recommerce & Sustainable Consumption (emerging)

Interest in recommerce and circular marketplaces is growing in several markets, especially among consumers who prioritize affordability and sustainability. Searches for “used,” “pre-owned,” and refurbished items are gradually increasing, signaling a shift toward more eco-conscious shopping behaviors.

Learn more: Navigating the Latest Shopee Trends: Essential Insights for Sellers

Data – The Key To Discover Shopee Search Trends 2025

Understanding Shopee search trends in 2025 requires far more than surface-level insights from common market tools—it demands data depth, accuracy, and true visibility into user behavior.

Limitations of Public Tools & Pre-Processed Datasets

In essence, public tools or pre-processed datasets created by sellers or marketers are limited in their advanced functionality. These limitations are critical drawbacks for data-driven businesses, specifically:

- Lack of granularity (no query-level data)

- No timestamps for each event

- Not suitable for AI/ML (due to rigid normalization)

- Lack of truly useful metadata

- No warehouse integration support

- Cannot validate or reproduce models (lack of reproducibility)

Strategic Advantages of Raw Shopee Search Data in Competitive Markets

Data-driven businesses need raw data to ensure important factors such as: accurate modeling, reproducibility of results, ease of verification and comparison, transparency in the analysis process, as well as enabling flexible experimentation. These are precisely the factors that common tools (public tools) or datasets cannot meet for data-driven businesses in today’s fiercely competitive environment.

The optimal solution that data-driven businesses are currently pursuing is to collect raw Shopee search data. Specifically, Raw Shopee Search Data helps businesses:

- Build proprietary predictive models: Independent of third-party algorithms.

- Develop high-speed data products: Raw data → easy to deploy pipelines → easy to productize as APIs, dashboards, data feeds.

- Generate superior competitive intelligence: If competitors only have public data → slower analysis → lack of accuracy.

- Fully control feature engineering: Can create: demand velocity, search volume derivative, trend acceleration, competitive density, cluster lifecycle metrics

- Scaling models over time: Raw data = open infrastructure, easy to scale as models grow larger.

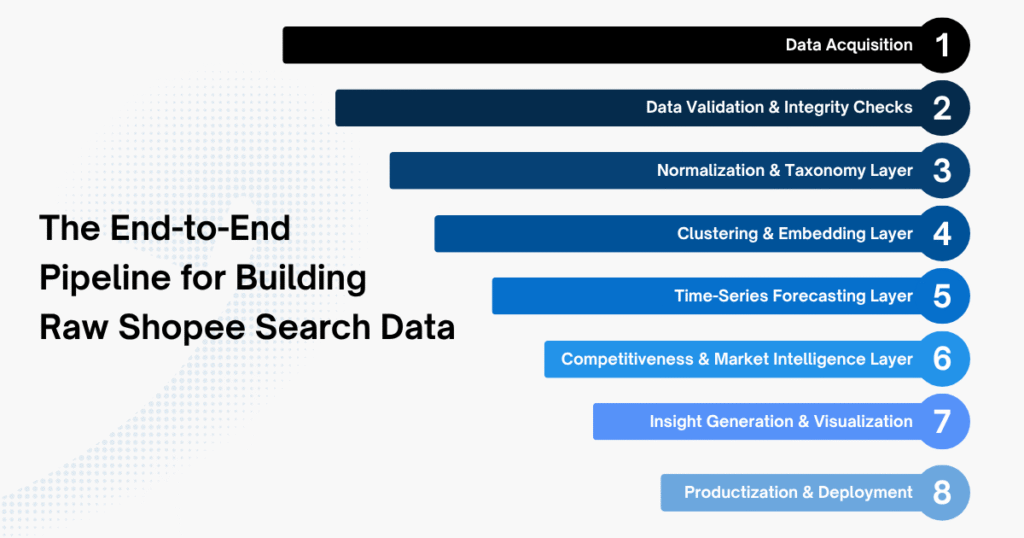

The End-to-End Pipeline for Building Raw Shopee Search Data

The end-to-end pipeline for converting raw Shopee search data into data products requires ensuring data depth, reliability, and scalability while covering the entire lifecycle from collection, standardization, modeling, data enrichment, to production. Specifically:

1. Data Acquisition (Raw Query-Level Data Collection)

- Collect all search queries

- Track volume, rank movement, timestamp

- Snapshot pipeline on a daily/hourly basis

2. Data Validation & Integrity Checks

- Remove duplication

- Check completeness

- Establish data observability

3. Normalization & Taxonomy Layer

- Tokenizing, stemming

- Map query → category, subcategory

- Create custom taxonomy to serve business logic

4. Clustering & Embedding Layer

- Training embeddings (LLM-based or transformer-based)

- Semantic clustering

- Query network graph construction

5. Time-Series Forecasting Layer

- Trend acceleration

- Seasonality modeling

- Predictive demand curves

6. Competitiveness & Market Intelligence Layer

- Merge search data with product & seller data

- Build competitiveness index

- Identify market gaps

7. Insight Generation & Visualization

- Create dashboards, APIs, alerts

- Build internal insight layers

8. Productization & Deployment

- API

- Warehouse integration

- Data feed subscription

- Role-based access & governance

Criteria for Evaluating a Raw Shopee Data Provider

Collecting raw data from Shopee requires significant technical expertise, so even strong data engineering teams struggle to maintain historical data, handle issues when Shopee changes its system structure, expand into multiple countries or categories simultaneously. These limitations reduce the accuracy and reliability of commercial data products. Partnering with a quality Shopee raw data provider helps businesses save resources and obtain better “raw materials” for building enterprise-grade data products.

Below are the most important criteria that data-driven businesses need to analyze, evaluate, and verify before deciding on a quality raw Shopee data provider to serve as the foundation for their entire data product ecosystem:

- Granularity: Query-level, timestamp-level

- Freshness: Updated daily/hourly

- Coverage: Full categories, no sampling bias

- Metadata richness

- Integration: API, S3/GCS export, warehouse-ready

- Data lineage & documentation

- Compliance (legal and ethical data acquisition)

- Scalability & SLA

- Methodology transparency

Easy Data (a company specializing in collecting and providing raw e-commerce data) is one of the reliable partners that data-driven businesses should consider. This company offers professional Shopee data scraping services that are highly customizable, ensuring accuracy, stability, multi-country scalability, and legal compliance for large data projects. Therefore, Easy Data will be a strategic partner, providing a stable and long-term data platform for businesses to develop a sustainable e-commerce data product ecosystem.

Conclusion

In the context of strong e-commerce growth led by multi-functional online shopping platforms (such as Shopee), understanding Shopee Search Trends has become a strategic factor for data-driven businesses to gain a competitive advantage. So how can businesses acquire this advantage? This article has likely helped data-driven businesses find the appropriate answer.

Leave a Reply