The diaper category on Shopee Vietnam has become one of the platform’s most competitive retail battlegrounds. Dozens of brands—from global leaders to emerging domestic labels—fight for visibility, customer trust, and pricing advantage in a space where parents are highly selective and switching costs are low. Despite this crowded landscape, three brands have pulled decisively ahead.

In October 2025, Huggies, Gooby, and Bobby together accounted for 38.5% of the category’s total revenue, according to EasyData’s market insight. Their dominance is not the result of short-term promotional spikes but the outcome of well-defined strategies spanning pricing, product positioning, marketing effectiveness, and platform execution.

This analysis examines the factors behind their success—how they structured their offerings, how they shaped consumer perception, and how they maintained an edge in a market where every percentage point of share is hard-won.

Market Overview: Who Leads the Race?

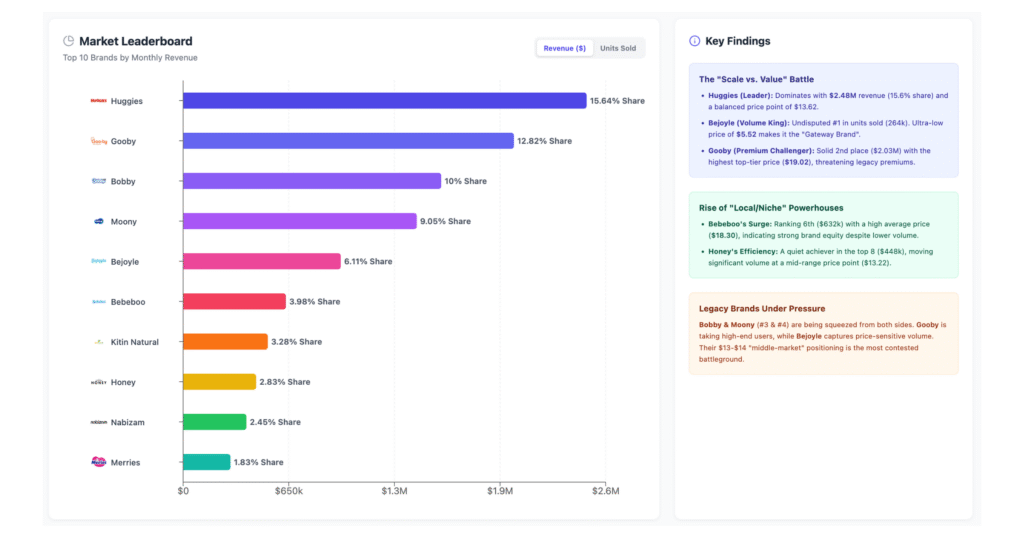

Before examining the strategic drivers behind the leading brands, it is important to understand how revenue is distributed across the category. The market’s hierarchy is clear, yet the underlying structure reveals a level of segmentation that shapes how each brand competes.

2.1 Revenue Ranking (October 2025)

The competitive structure of the diaper category becomes clear when examining revenue distribution. In October 2025, three brands stood significantly ahead of the field:

- Huggies — 15.64% market share

- Gooby — 12.82% market share

- Bobby — 10% market share

Together, they account for more than half of total category revenue. What is notable is not only their scale but their differentiated positioning. Each brand operates in a distinct price tier, allowing them to expand the category rather than compete directly for the exact same shopper profile. This segmentation reduces overlap and creates room for each to build dominance within its respective lane.

2.2 Segment Positioning

A closer look at pricing tiers helps explain this dynamic:

- Huggies competes across both mid-range and premium, supported by a broad SKU portfolio that captures families with varying budgets.

- Gooby is firmly positioned in the premium tier, targeting consumers seeking elevated quality and willing to pay a higher price per unit.

- Bobby remains anchored in the traditional mid-range, relying on consistency, familiarity, and strong household recognition.

This spread across pricing segments sets the stage for understanding how each brand grew its share. With minimal direct cannibalisation, their strategies reflect different approaches to value, trust, and platform execution—elements explored in the following analysis.

The Strategies Behind the Success of the Top 3 Brands

The dominance of Huggies, Gooby, and Bobby is rooted in a set of deliberate strategic choices. While each brand leads a different price tier, their success reflects how effectively they align pricing, positioning, and platform execution with the expectations of Shopee’s parent-driven customer base. The following analysis breaks down the approaches that enabled each brand to outperform the broader category.

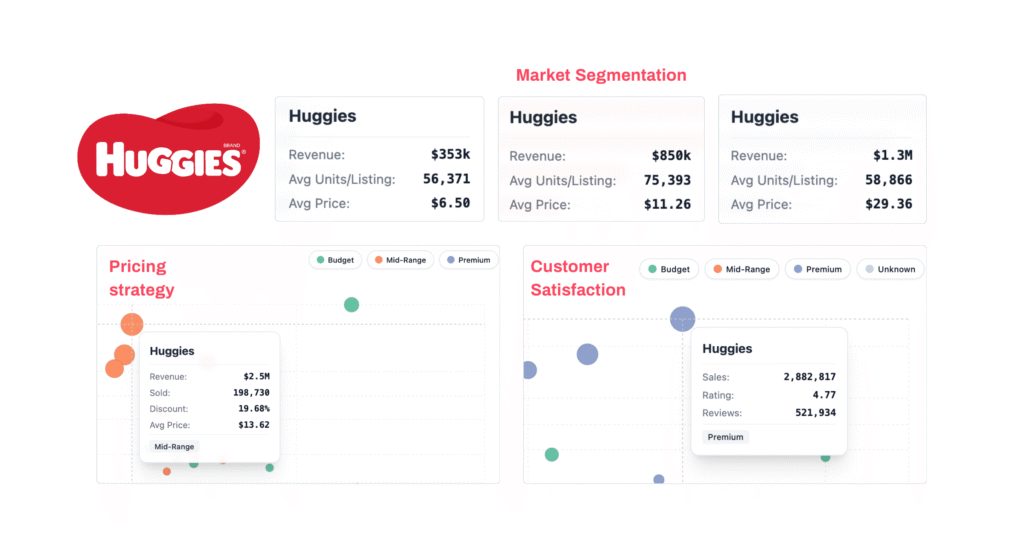

Huggies: The Omnichannel Powerhouse Dominating Every Segment

- Market Segmentation: Huggies is the only brand with meaningful presence across all price tiers—budget, mid-range, and premium. This broad segmentation allows the brand to capture multiple shopper segments, from price-sensitive parents to those prioritizing premium features. Its laddered portfolio reduces customer leakage by offering an upgrade or downgrade path within the same brand.

- Customer Satisfaction & Brand Loyalty: Huggies benefits from one of the strongest trust profiles in the category. Parents perceive the brand as safe, consistent, and dermatologist-approved, enabling it to secure loyalty even when alternatives offer lower prices. Its long-standing reputation also encourages repeat purchases, especially in early infancy stages where switching behavior is common.

- Pricing & Discount Strategy Analysis: With an average price of $13.62 and controlled discounts around 19–20%, Huggies demonstrates disciplined pricing. Rather than competing through aggressive promotions, the brand maintains a stable price band that reinforces reliability. This approach also aligns with its multi-tier segmentation, preventing price cannibalization between product lines.

Gooby: The Premium Brand Winning the “Affordable Luxury” Battle

- Market Segmentation: Gooby operates almost exclusively in the premium tier, focusing on parents who prioritize comfort, skin protection, and product quality. This deliberate concentration enables the brand to avoid direct competition with value-oriented players and instead compete for customers willing to invest more in baby essentials.

- Customer Satisfaction & Brand Loyalty: Although newer compared to long-established brands, Gooby has built strong loyalty by emphasizing premium materials, softness, and safety. Parents who experience satisfaction with premium categories tend to remain within them, giving Gooby a growing base of repeat buyers. Its brand narrative conveys elevated care, supporting retention among middle- and upper-income households.

- Pricing & Discount Strategy Analysis: Gooby holds the highest average price among the top three brands at $19.02. Despite this, it ranks second in revenue—evidence that customers perceive its products as worth the premium. Discounts remain modest (~19%), indicating that demand is driven more by quality signals than promotional incentives. The brand’s value positioning protects it from price-driven competition.

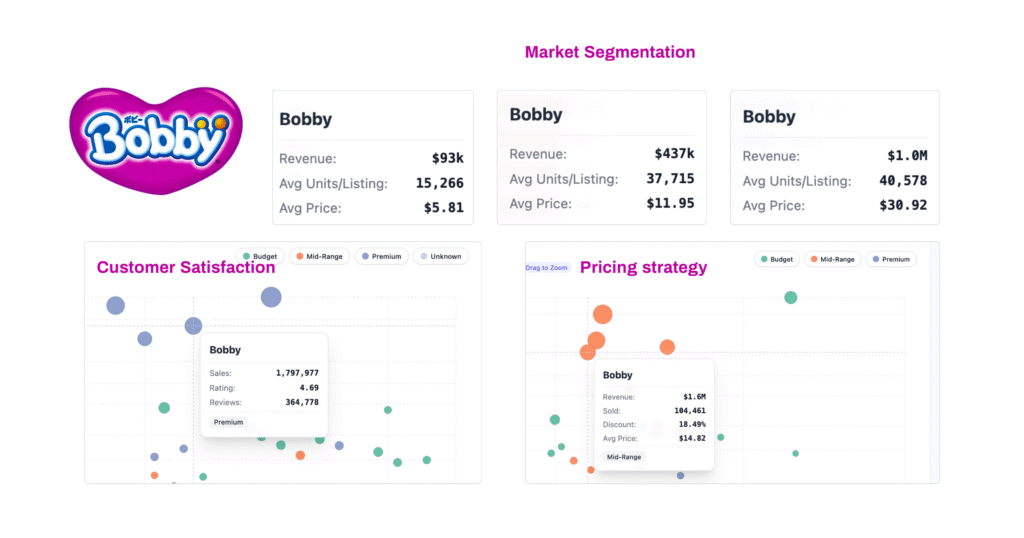

Bobby: The Traditional Mid-Range Player Holding Strong Despite Pressure

- Market Segmentation: Bobby remains firmly situated in the mid-range segment. This positioning appeals to families seeking dependable performance without trading up to premium pricing. However, this also places Bobby between two strong competitors—Huggies in the mid-range and Gooby in the premium tier—creating a competitive squeeze.

- Customer Satisfaction & Brand Loyalty: Bobby’s core strength lies in familiarity. As a long-standing household name, the brand retains a loyal base of customers who value predictability and comfort. Many parents view Bobby as a practical choice, especially for older babies and toddlers, where absorption and comfort expectations differ from newborn needs.

- Pricing & Discount Strategy Analysis: With an average price of $14.82, Bobby sits between Huggies and Gooby. Its discounts average around 18%, reflecting a steady promotional strategy that avoids overly aggressive cuts. This consistency supports its positioning as a reliable everyday option while preventing downward pressure on perceived value.

Final Thoughts

The dominance of Huggies, Gooby, and Bobby on Shopee Vietnam is not the result of short-term promotional activity but the outcome of well-defined strategies aligned with clear consumer needs. Each brand succeeds within its own competitive lane: Huggies leverages broad segmentation and strong trust to influence the market at every price tier; Gooby demonstrates that a focused premium position can drive substantial revenue when supported by consistency and perceived value; and Bobby maintains relevance through stability, familiarity, and a clear mid-range identity.

Their approaches reveal several underlying principles shaping the diaper category on Shopee: segmentation must be intentional, loyalty is built through both quality and communication, pricing discipline strengthens brand equity, and content execution increasingly determines conversion outcomes. Brands that understand and apply these dynamics are better positioned to capture share in a category where demand is constant but competition remains intense.

As the market continues to evolve, the most successful players will be those that combine data-driven decision-making with a clear understanding of how parents evaluate trust, value, and performance. The strategies of the top three brands provide a roadmap for how to compete—and win—in one of Shopee Vietnam’s most challenging and fast-moving categories.

Leave a Reply