Before Shopee scrape is discussed as a technical activity, it should be reframed as a market observation capability. At scale, scraping Shopee is less about extracting pages and more about capturing how products, sellers, and categories evolve in response to demand. When approached through a market intelligence lens, Shopee scrape becomes a foundational input for understanding competitive dynamics long before they surface in obvious performance metrics.

What Does “Shopee Scrape” Mean in a Market Intelligence Context?

Shopee scrape is often interpreted narrowly as a way to pull data from an e-commerce platform. In practice, within market intelligence, it refers to the systematic extraction of marketplace signals that describe how supply is structured, how demand is expressed, and how competition takes shape over time.

Rather than focusing on individual listings, Shopee scrape enables a market-wide view. It allows analysts and decision-makers to observe changes in assortment, seller behavior, pricing logic, and category maturity at scale. The value does not come from isolated data points, but from patterns that only emerge when data is collected consistently and analyzed longitudinally.

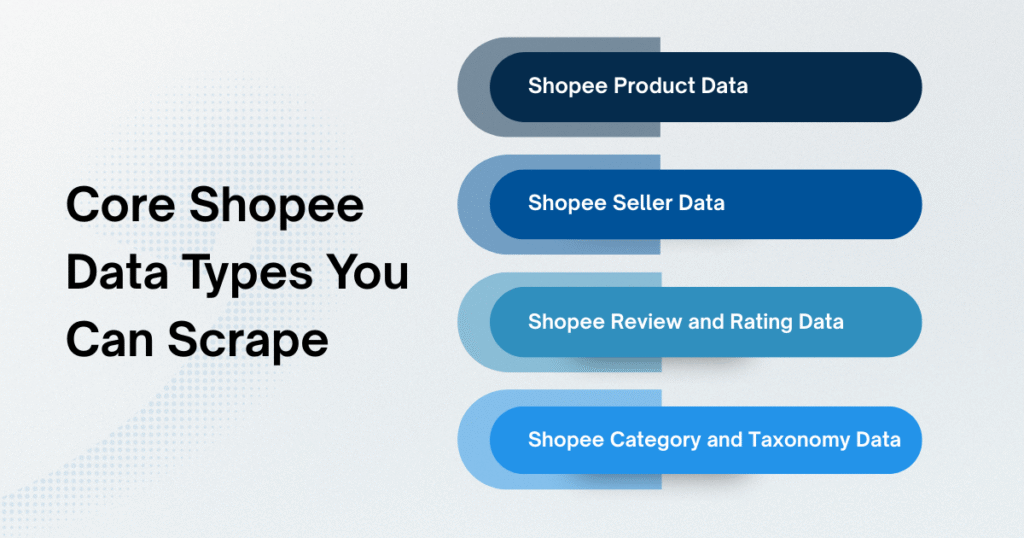

Core Shopee Data Types You Can Scrape

Shopee’s value as a data source lies in the diversity of signals embedded within its marketplace structure. Different data types illuminate different aspects of market behavior.

Shopee Product Data

Product-level data forms the structural foundation of Shopee scrape. Beyond titles and attributes, it reflects how sellers collectively interpret consumer demand at any given moment. Variations in naming, feature emphasis, and product configurations reveal how a category is still being defined (or redefined) by the market itself.

From a market intelligence perspective, product data is most valuable when observed longitudinally. Shifts in attributes, bundling logic, or variant proliferation often signal experimentation phases, where sellers test assumptions before a dominant product standard emerges. These early patterns rarely appear in sales metrics but surface clearly in product data.

Shopee Seller Data

Seller data provides visibility into the competitive structure behind the assortment. By analyzing seller concentration, brand participation, and entry-exit patterns, Shopee scrape reveals whether a category is consolidating or still fragmented.

High seller fragmentation often indicates unresolved demand, where no single player has successfully standardized an offering. Conversely, increasing seller concentration suggests that market norms are solidifying. Seller behavior therefore acts as a proxy for competitive maturity, helping analysts understand not just who is selling, but how stable the market has become.

Shopee Review and Rating Data

Review data captures demand-side feedback at a level of granularity that structured metrics cannot. Beyond sentiment, reviews expose expectation gaps (features customers assume should exist but do not), quality thresholds that are inconsistently met, or use cases that sellers did not anticipate.

In early-stage categories, review patterns are often fragmented and contradictory. This inconsistency is itself a signal: it indicates that the market has not yet aligned on what “good” looks like. As categories mature, review narratives tend to converge around standardized expectations.

Shopee Category and Taxonomy Data

Category and taxonomy data reflect how the platform frames demand structurally. Changes in category depth, the emergence of new subcategories, or overlapping classifications often signal shifts in consumer behavior or platform-level optimization strategies.

From a market intelligence standpoint, scraping category structures over time helps teams understand how markets are being institutionalized. When a platform formalizes a subcategory, it often confirms that demand has reached a scale worth organizing, sometimes earlier than external trend signals suggest.

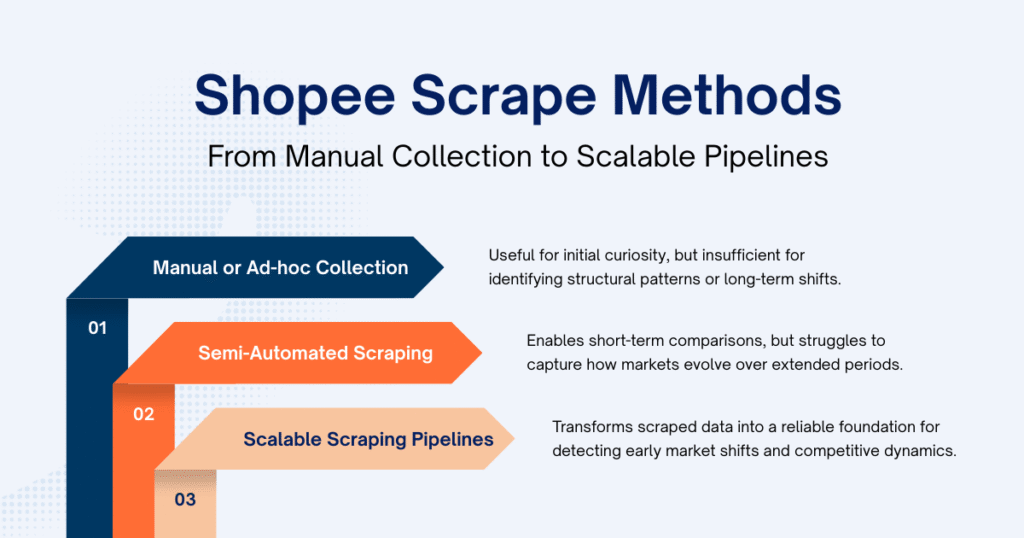

Shopee Scrape Methods: From Manual Collection to Scalable Pipelines

Shopee scrape methods are often discussed in terms of efficiency or scale, but their real impact lies in how they shape market visibility. Different collection approaches influence whether data captures momentary snapshots or sustained market behavior.

For market intelligence, consistency matters more than speed. Sporadic or one-off scraping produces isolated observations, while systematic collection creates continuity. This continuity is what allows analysts to distinguish between noise and structural change, between temporary fluctuations and genuine shifts in demand or competition.

At scale, scraping methods become less about extraction and more about signal preservation. Poorly structured or inconsistent data obscures patterns, while stable pipelines allow insights to compound over time.

Why Shopee Scrape Is Foundational for Market Intelligence

Shopee scrape matters not because it provides data, but because it provides early visibility. Sales performance and rankings tend to confirm what has already happened. Scraped marketplace data, by contrast, captures what is forming.

Through Shopee scrape, organizations can observe:

- Emerging demand before it consolidates

- Competitive crowding before price wars begin

- Assortment gaps before standards are set

In this sense, Shopee scraping functions as an early-warning system for market shifts, enabling proactive rather than reactive decision-making.

Learn more: Shopee Product Scraping as Market Intelligence, Not Just Data Collection

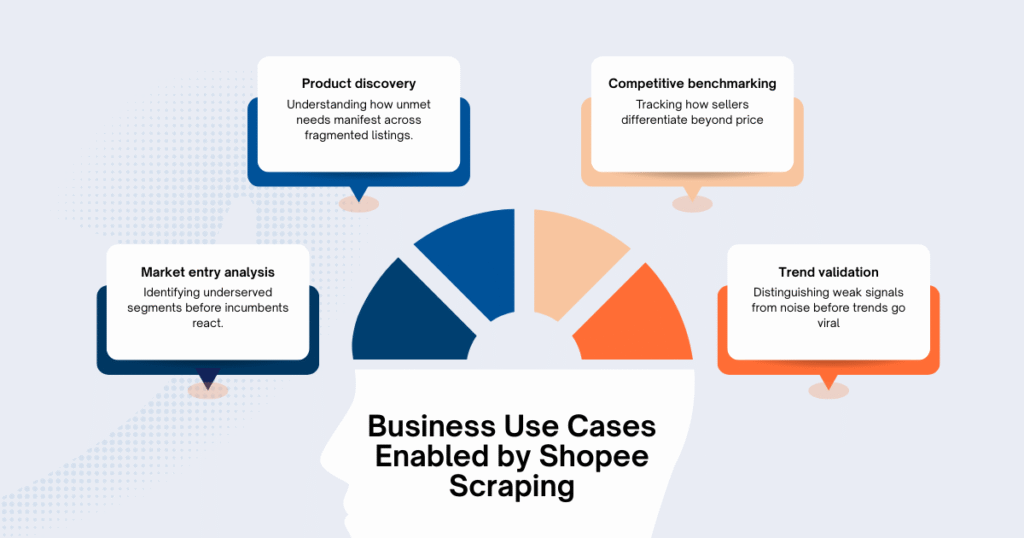

Business Use Cases Enabled by Shopee Scraping

When applied as a market intelligence input, Shopee scrape supports decisions that depend on timing rather than confirmation.

- Market entry analysis benefits from scraped data by revealing underserved segments before competitive norms are established. Instead of reacting to visible leaders, organizations can identify where supply remains fragmented and standards are still fluid.

- Product discovery often relies on recognizing unmet needs that surface during the early stages of a product life cycle, where demand is visible but offerings remain fragmented and inconsistent. Shopee scrape makes these weak signals visible at scale, enabling structured exploration rather than anecdotal intuition.

- Competitive benchmarking moves beyond price comparison. By tracking assortment logic, positioning language, and seller behavior, teams gain insight into how competitors differentiate, and where those strategies fail to fully satisfy demand.

- Trend validation becomes more precise when early signals are separated from noise. Rather than chasing virality, Shopee scrape allows teams to observe whether emerging patterns are stabilizing across sellers and categories.

Across all use cases, the common advantage is temporal. Shopee scrape shifts decision-making earlier in the market lifecycle, when strategic options remain open and competition is still forming.

Scaling Shopee Scrape: From Samples to Market Coverage

As analytical scope expands, Shopee scrape transitions from a data task to an infrastructure challenge. Coverage, freshness, and consistency become critical. Partial datasets can misrepresent market structure, while stale data obscures momentum shifts.

Scaling Shopee scrape effectively means treating it as an ongoing process rather than a one-time extraction, especially when analyzing millions of products or tracking markets across multiple time periods.

Shopee Scrape as Infrastructure, Not a One-Time Task

As Shopee scrape moves from isolated experiments to continuous market observation, the challenge shifts from extraction to sustainability. Maintaining coverage, consistency, and historical continuity becomes essential, especially when tracking how markets evolve over time rather than capturing one-off snapshots.

In practice, this is where the distinction between ad-hoc scraping and data infrastructure becomes visible. Sustained market intelligence requires access to raw, well-structured marketplace data that can be observed repeatedly, compared across periods, and reinterpreted as business questions change. Rather than relying on fixed interpretations, some organizations work with raw e-commerce data providers such as Easy Data, which focus on delivering large-scale Shopee datasets generated through Shopee data scraping, designed to support long-term analytical flexibility.

By treating Shopee scrape as infrastructure rather than a one-time task, teams retain control over how market signals are explored and validated. Insight is no longer constrained by the limitations of a single report or dashboard, but can evolve alongside the market itself.

Final Thoughts

Shopee scrape is often misunderstood as a technical shortcut. In reality, it is a strategic lens. By capturing product, seller, and category signals early, Shopee scraping allows organizations to observe markets before narratives form and competition hardens.

For teams focused on long-term advantage, Shopee scrape is not about collecting more data, it is about seeing the market sooner and more clearly than others.

Leave a Reply