Shopee raw data is a foundational layer of data that is often misunderstood in ecommerce intelligence. It is not merely “unprocessed” data; it reflects how the market operates before any analytical assumptions are imposed. Understanding the true role of Shopee raw data helps businesses build more flexible and sustainable analytical systems over time.

What Do We Mean by “Shopee Raw Data”?

Shopee raw data refers to unprocessed marketplace data captured directly from Shopee before any normalization, aggregation, or analytical transformation occurs. It reflects how information exists at the source, not how it is later interpreted. In most ecommerce contexts, Shopee raw data includes:

- Product listings with original attributes and variants

- Seller-level identifiers and storefront metadata

- Category and subcategory paths as structured by Shopee

- Pricing fields before normalization (base price, discounted price, promotions)

- Search rankings and visibility indicators

- Review counts, ratings, and engagement signals

Crucially, raw data preserves context and structure, even when that structure is inconsistent or noisy. This is both its strength and its challenge.

Shopee raw data is not designed for immediate analysis. It is designed to be flexible, allowing teams to apply their own logic rather than inherit assumptions embedded in pre-processed datasets.

Shopee Raw Data vs Processed Shopee Datasets

Understanding the role of raw data requires distinguishing it clearly from processed or analysis-ready datasets.

| Dimension | Shopee Raw Data | Processed Shopee Dataset |

| Data state | Unfiltered, unnormalized | Cleaned and structured |

| Flexibility | Very high | Medium |

| Ease of use | Low | High |

| Risk of inconsistency | High | Lower |

| Best suited for | Custom intelligence systems | Reporting, dashboards |

Shopee raw data gives teams maximum control, but also places responsibility on them to manage data quality, consistency, and structure. Processed datasets trade that flexibility for speed and reliability.

The key point is not that one is better than the other but that they serve different stages of the intelligence stack.

Why Shopee Raw Data Matters and How It Is Actually Used

Shopee raw data is only truly valuable when it is collected and leveraged as a foundation for open analysis (often through Shopee data scraping) rather than reduced to pre-packaged reports. In practice, it is not the data itself but how raw data is used that determines the value of the ecommerce intelligence it ultimately generates.

Why Raw Data Is Foundational for Ecommerce Intelligence

Raw data matters because it captures market reality before interpretation.

At scale, ecommerce platforms continuously change how they structure categories, attributes, and listings. Processed datasets often mask these changes. Raw data preserves them.

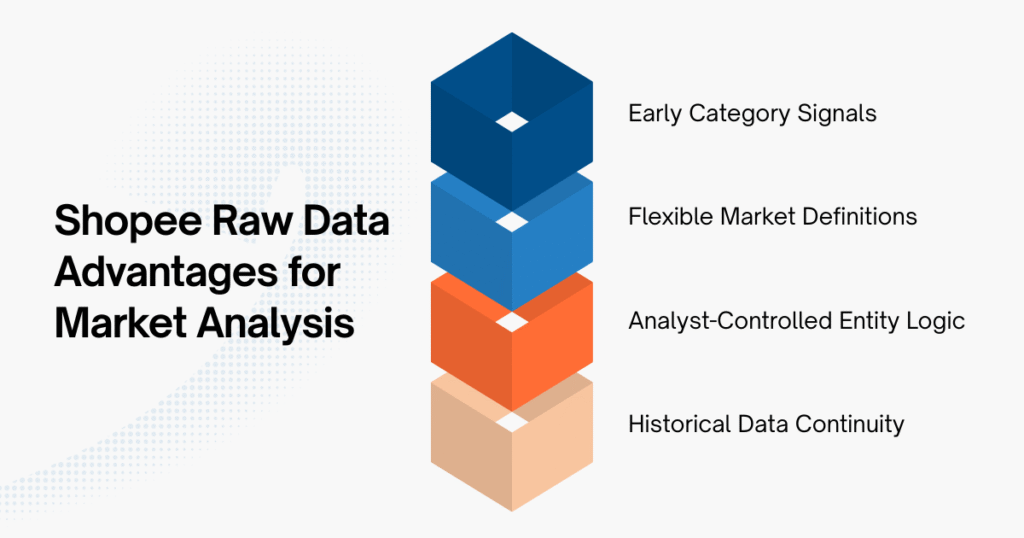

For intelligence teams, this enables:

- Early detection of emerging categories before taxonomy updates

- Flexible reclassification as market definitions evolve

- Control over deduplication and entity resolution logic

- Historical continuity even when platform structures shift

In short, Shopee raw data allows analysts to define markets on their own terms rather than inheriting fixed assumptions.

Common Use Cases Built on Shopee Raw Data

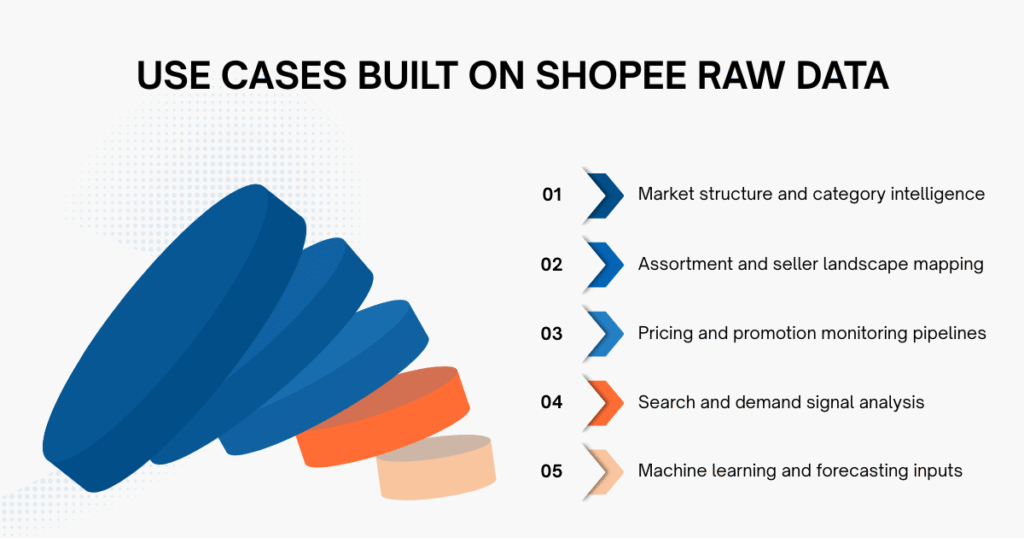

Shopee raw data is rarely the final analytical output. Instead, it acts as a foundation layer for:

- Market structure and category intelligence

- Assortment and seller landscape mapping

- Pricing and promotion monitoring pipelines

- Search and demand signal analysis

- Machine learning and forecasting inputs

Teams that rely on raw data typically value adaptability over convenience, especially when intelligence needs evolve over time.

The Real Challenges of Working with Shopee Raw Data

While powerful, raw data introduces real operational complexity. Common challenges include:

- Inconsistent product attributes across sellers

- Duplicate listings across categories and search paths

- Frequent structural changes in Shopee’s frontend and backend

- High maintenance costs for ongoing data validation

Without disciplined pipelines, raw data can quickly degrade into fragmented or misleading datasets. This is why raw data should never be confused with “ready-to-use” data.

From Shopee Raw Data to Analysis-Ready Datasets

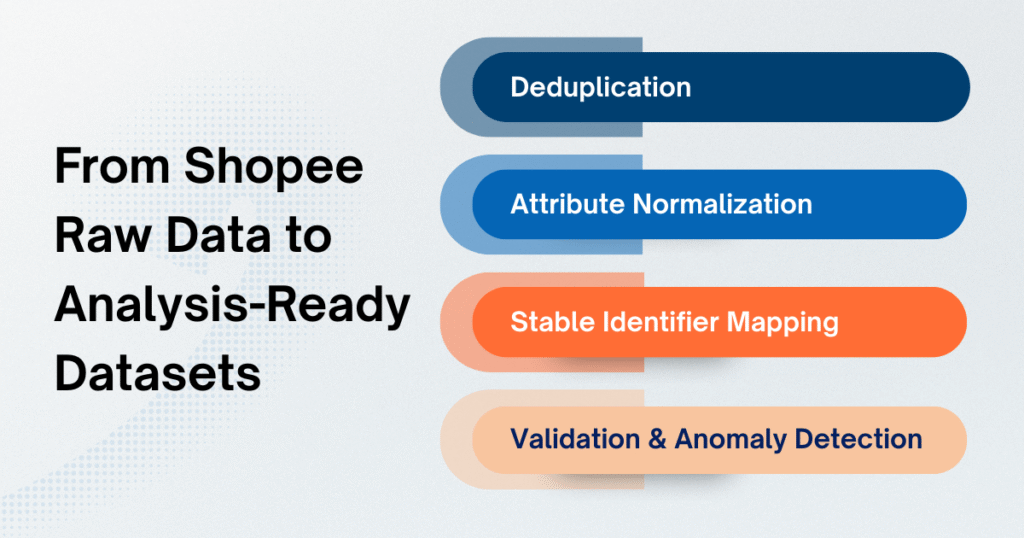

Transforming raw data into usable intelligence typically requires a structured pipeline that includes:

- Deduplication across listings, sellers, and category paths

- Attribute normalization for variants, bundles, and pricing fields

- Stable identifier mapping to preserve historical continuity

- Validation and anomaly detection to catch silent failures

This transformation layer is where most of the real analytical value is created. Teams that skip or rush this step often discover downstream inconsistencies that are difficult (or impossible) to correct later. In other words, Shopee raw data only becomes valuable when paired with deliberate data design.

Where Managed Shopee Dataset Services Fit In

As data operations scale, many organizations find that maintaining raw Shopee data pipelines consumes resources better spent on analysis. In these cases, managed Shopee dataset services serve as infrastructure partners, not analytical replacements. Their role is to:

- Continuously collect and stabilize Shopee raw data

- Apply consistent structuring and quality controls

- Deliver datasets that remain adaptable over time

Providers such as Easy Data operate at this layer, supplying large-scale Shopee datasets built from raw data while allowing internal teams to retain full control over analysis, modeling, and strategic interpretation. This approach balances flexibility with operational sustainability.

Final Thought

Shopee raw data remains essential because it captures the market before assumptions are imposed. While it demands careful handling, it offers unmatched flexibility for teams building long-term ecommerce intelligence systems.

When treated as foundational input (rather than an end product), Shopee raw data enables deeper insights, earlier signals, and intelligence architectures that evolve alongside the market itself. Used strategically, it is not just data. It is the groundwork upon which meaningful ecommerce analysis is built.

Leave a Reply