Shopee data for sellers has become a critical resource for competitive e-commerce operations in Southeast Asia. With marketplaces like Shopee dominating in markets such as Singapore, Malaysia, Vietnam, Indonesia, and more, sellers are under increasing pressure to make data-driven decisions: which products to list, how to price, how to outmaneuver competitors, and how to capture demand early.

In this case study, we examine how a Singapore-based Shopee seller leveraged Shopee data for seller — gathered, processed, and analyzed through a third-party data service — to dramatically increase revenue, improve margins, and scale more sustainably. The lessons here are actionable for sellers across SEA.

We’ll walk through:

- The seller’s initial challenges

- How they used Shopee data (what metrics, what dashboards)

- Strategies they applied (pricing, product mix, trend spotting)

- Tangible results

- Lessons you can apply

- How Easy Data supports sellers via data crawling services and Shopee datasets

Seller Profile and Initial Challenges

Before leveraging Shopee Data for Seller, understanding the market landscape and competitive dynamics was one of the biggest challenges for this Singapore-based seller. Like many others on Shopee, they faced intense competition, fast-changing trends, and limited visibility into what truly drove performance.

Seller Background

- Location: Singapore

- Niche: Consumer electronics accessories (phone cases, chargers, etc.)

- Size: Mid-tier seller, offering 500+ SKUs on Shopee Singapore

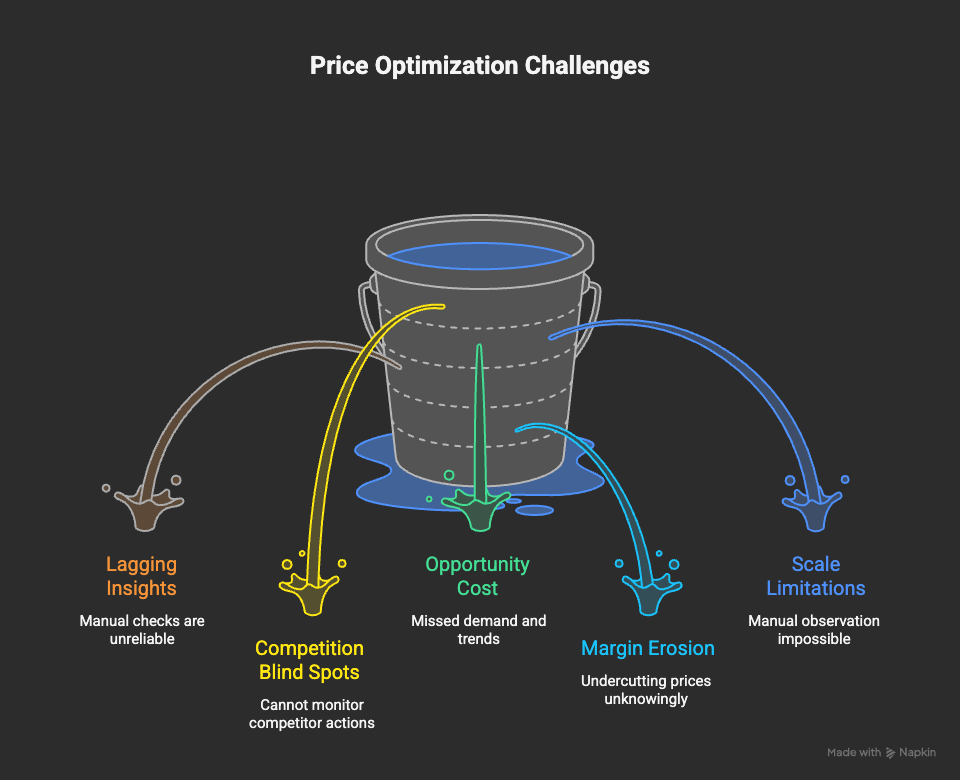

Key Challenges Before Data Use

- Lagging insights: They relied on manual checks and “feel” to adjust prices.

- Competition blind spots: They couldn’t systematically monitor what competitors were doing.

- Opportunity cost: They missed demand surges and trending products.

- Margin erosion: Frequent undercutting of price without knowing competitor elasticity.

- Scale limitations: As the number of SKUs and competitors grew, manual observation became impossible.

The seller realized they needed Shopee data for seller-level insights — not just generic market reports, but granular data they could act on.

Implementing Shopee Data: Approach & Methodology

Choosing a Reliable Data Partner

The seller partnered with Easy Data to access robust Shopee data crawling and analytics services. Easy Data provides Easy Data Expert Shopee Data Crawling Services in SEA, a specialized service for extracting e-commerce data across Southeast Asia. (Internal link)

Additionally, they tapped into the Shopee Dataset maintained by Easy Data, a curated collection of cleaned, ready-to-analyze Shopee data. (Internal link)

These services include:

- Automated crawling of Shopee listings (price, sales, reviews, rank)

- Cleaning, deduplication, and data normalization

- Time-series tracking (price changes over time)

- Dashboards, alerts, and strategy reports

What Data They Focused On

Together with Easy Data, the seller defined essential metrics:

- Price movements and discounts among top competitors

- Sales rank / units sold estimates

- Review counts & average ratings

- New product launches in their niche

- Historical pricing trends to spot recurring patterns

- Behavior during promotional events

- Stock / availability monitoring

Alerts were configured: e.g. “If competitor X drops price on SKU Y by more than 5%, notify me.”

Data Dashboards & Tools

The seller used visualization dashboards to show:

- Correlation of price vs sales volume

- Competitor price bands & margin zones

- Life cycle curves (product launch → peak → decline)

- Trend projections to identify rising SKUs

They also exported data for deeper analysis via spreadsheets and ML tools.

Strategic Actions Based on Shopee Data for Seller

Using the insights from the data, the seller implemented several strategies:

1. Smart Pricing Adjustments

- When competitor prices dropped, they adjusted for only SKUs where margin allowed.

- For high-value SKUs (brand strength, reviews), they maintained price and used bundle offers instead.

- In times of high demand, they increased prices slightly and dynamically.

2. Product Portfolio Optimization

- Underperforming SKUs (low sales relative to inventory) were phased out.

- SKUs with upward trends got more variants (colors, bundle packages).

- Complementary items (often bought alongside top sellers) were added to cross-sell.

3. Trend Capture & Early Entry

- By analyzing historical competitor data, they forecasted trending accessories.

- They launched new SKUs early with competitive pricing.

- When trends accelerated, they increased inventory to match demand.

4. Review & Reputation Monitoring

- They tracked competitor review spikes or drops to detect product issues.

- If a competitor received negative feedback, they pushed alternative SKUs with promotional focus.

5. Promotional Timing & Stock Planning

- Inventory was aligned ahead of known sale spikes (e.g. 11.11, monthly campaigns).

- Stockouts were minimized via competitor stock-level monitoring.

- Discounts were strategically timed, not randomly abused.

Results & Metrics: Revenue Boost & Efficiency Gains

After six months of employing data-driven strategies, the seller saw meaningful improvements:

| Metric | Before Data Strategy | After (6 months) | % Improvement |

|---|---|---|---|

| Monthly revenue | SGD 40,000 | SGD 56,000 | +40% |

| Gross margin | ~28% | ~33% | +5 pp |

| Contribution of top SKUs | 20% of SKUs | 35% of SKUs | +15 pp |

| Stockouts per month | 12 | 4 | –66% |

| Price responsiveness | Manual / weekly | Real-time alerts | — |

| ROI on data investment | — | > 8× | — |

Key takeaways:

- Revenue jumped ~40% while margins improved.

- More SKUs became meaningful revenue contributors.

- Stockouts dropped sharply.

- The return on investment in data services exceeded 8× within months.

Why the Strategy Worked

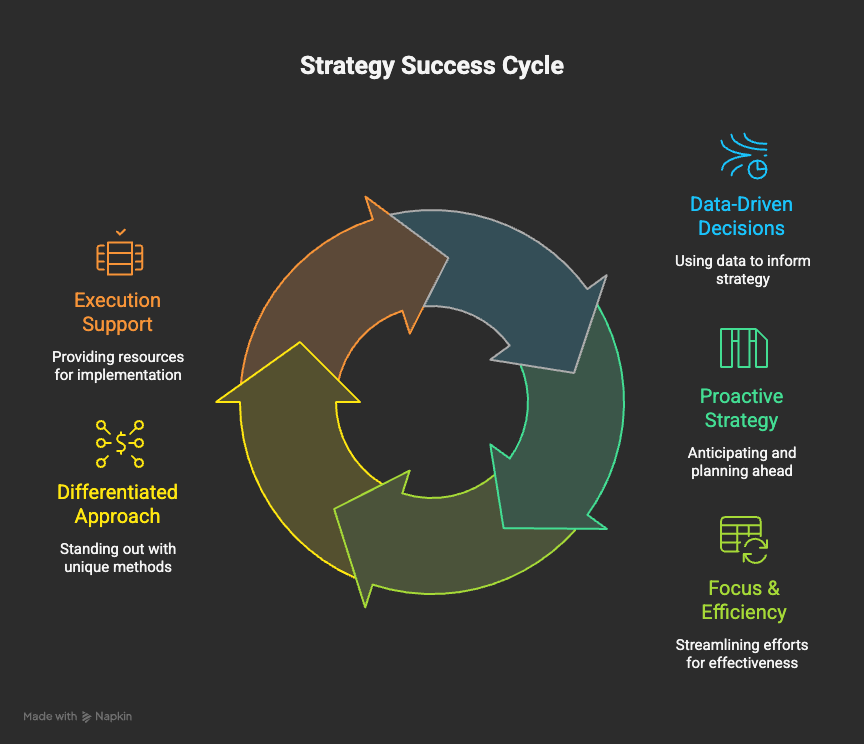

Data-Driven Decisions

Every major move—pricing, SKUs, promotions—was backed by Shopee data for seller-level insight rather than guesswork.

Proactive Strategy

Instead of chasing competitors, the seller anticipated their moves and acted first.

Focus & Efficiency

By shedding underperforming SKUs, they redeployed resources more effectively.

Differentiated Approach

They didn’t chase lowest price all the time—some SKUs were defended on brand and service value.

Execution Support

Using Easy Data Expert Shopee Data Crawling Services in SEA and the Shopee Dataset, the seller offloaded technical burdens and focused on strategy.

Lessons You Can Apply as a Seller

- Define meaningful metrics tied to your business (price, sales, reviews).

- Set up alerts to catch competitor shifts quickly.

- Use trend forecasting to be first to market.

- Regularly prune SKUs that drain capital.

- Price smartly—don’t always undercut.

- Monitor review & reputation signals.

- Align stock with predicted demand to avoid lost sales.

- Continuously test and iterate.

Even if your catalog is modest today, start with a subset and scale as you validate.

How Easy Data Supports Shopee Data for Seller

To help sellers replicate this success, Easy Data provides two critical assets:

- Easy Data Expert Shopee Data Crawling Services in SEA: a cross-region crawling infrastructure that pulls dynamic product, pricing, review, ranking data to deliver real-time insights for sellers.

- Shopee Dataset: a clean, normalized, ready-to-use dataset tailored for analytics, dashboards, or machine learning use.

With these, sellers avoid building scrapers or data pipelines themselves. Easy Data offers:

- Custom dashboards & alerts

- Data export / API integration

- Strategy support based on data signals

- Ongoing maintenance & updates

Thus, sellers can focus on execution while data infrastructure is handled by experts.

Addressing Concerns & Ethical Considerations

Compliance & Policy Risks

When collecting shopee data for seller, it’s vital to respect platform policies and privacy regulations. Partnering with a reputable service like Easy Data helps mitigate risks.

Data Quality & Noise

Raw scraped data may include duplicates or inconsistencies. Proper cleaning and validation—tasks handled by Easy Data—are essential.

Trend Overreaction

Avoid overcorrecting from short-lived fluctuations. Use smoothing methods, avoid chasing every price war.

Sustainable Strategy

Data-driven tactics should support long-term growth, not just short-term spikes.

Conclusion & Call to Action

This case study demonstrates how shopee data for seller can transform your operations from reactive to proactive. The Singapore seller raised revenue by 40%, improved efficiency, and scaled smarter within six months.

If you’re ready to replicate this kind of success, you don’t have to build everything yourself. Leverage specialized services:

- Use Easy Data Expert Shopee Data Crawling Services in SEA to access high-quality, real-time Shopee data.

- Tap into the Shopee Dataset offered by Easy Data for clean datasets ready for analysis.

🔥 Want to grow smarter using Shopee data for seller? Contact Easy Data today and let us help you turn raw data into revenue-driving strategies.

Leave a Reply